After a record 128-month-long economic expansion, the U.S. is officially in a recession, according to the National Bureau of Economic Research. Many of the goals and strategies financial institutions had put in place earlier this year have been upended by the coronavirus pandemic. Now, banks and credit unions must determine how to safely and effectively manage risk in the portfolio while also driving growth at their institution. This recession is significantly different than the 2008 financial crisis, creating a unique credit environment for financial institutions. Despite the uncharted waters, there are several key credit risk best practices that institutions can fall back on.

Best Practices for Managing Credit Risk in Recession

August 5, 2020

Read Time: 0 min

Key Takeaways

- This recession is significantly different than the 2008 financial crisis, creating a unique credit environment for financial institutions.

- Economic downturns alter the credit memo's content and process to capture credit risk.

- Loan grading will need to be tweaked and specific sectors may need to be treated differently in the face of a recession.

Bolstering credit memos in an economic downturn

Credit memos are one of the most important documents in the life of the loan, as loan committees use these documents to determine whether or not to approve a loan. Therefore, it’s essential that the credit memo captures the complete picture of the borrower to ensure proper risk management. In good economic times, when banks and credit unions are experiencing minimal losses, it’s easy for financial institutions to become complacent when developing credit memos and perhaps allow policy exceptions to slip by.

Michael Wear, Owner of 39 Acres Corporation, a firm specializing in banker training and consulting services in credit risk underwriting and loan portfolio management, joined Abrigo’s webinar series, “How to Manage Credit Risk in a Recession: A Series Examining Best Practices,” to give insights into best practices and strategies financial institutions can leverage to manage and strengthen credit risk during these uncertain times. The first area Wear recommends bolstering is credit memo content and analysis. During these uncertain economic times, Wear explained, many financial institutions might only capture a short snapshot of its financials, discussing the last fiscal year-end and year-to-date results, but failing to provide forward-looking projections or an extensive discussion of potential weaknesses. Credit memos should provide facts – even if they aren’t pretty. This is especially true in an economic downturn.

To provide better analysis in the credit memo, financial institutions should focus on the “why.” Simply providing data tables and charts is not enough. “Tell me what’s driving those numbers and those trends,” Wear said. “Get behind the numbers and show me you’ve done your homework.” Particularly in the current economic environment, lenders and analysts should consider the industry impacts and the influence supply and demand may have on their clients.

Credit memos should have a factual, objective foundation. Wear suggests using the “S-W>U” formula, in which the strengths of the deal, minus the weaknesses, are greater than the uncertainties. “Finding strengths and weaknesses is the easy part,” Wear said. “The hard part is addressing uncertainties, and this is where your industry and supply vs. demand research can produce rational ‘what-if’ analyses.” Addressing uncertainties in today’s economic environment is especially complicated. The impact of the coronavirus is fairly localized, hitting businesses and industries in certain areas much harder than others. But has the financial institution considered the client’s full supply chain and where they’re located? The national effects remain opaque and will continue to change – do not get complacent.

Mitigate credit risk and drive growth – even in a recession.

Learn MoreImproving loan grading in a recession

Loan grading is another pillar of managing credit risk that should be evaluated frequently. Each institution’s loan grading scale is unique to the bank or credit union, but all scoring models must be able to identify, quantify, and measure risk within the loan portfolio. Financial institutions must measure early and often to stay ahead of the curve. Solid loan grading systems must be carefully considered and defined, effectively communicated, and steadfast in both good and bad times. Loan grading scales, weighting, and adjustment levels should be a direct reflection of the institution’s credit culture and past lending experiences – especially those painful losses, Wear explained.

“I firmly believe to attain – and then maintain – consistent bank performance, we must balance three priorities in this order: soundness, profitability, and then growth,” Wear said. “Loan grading is a connector between credit policy and behavior. It measures – albeit with a snapshot – how the credit or borrower’s behaving in light of policy and it is also a defender of credit culture.”

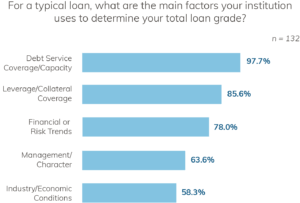

The main factors institutions use to determine the total loan grade are debt service coverage/capacity (97.7%) and leverage/collateral coverage (85.6%), according to an informal poll conducted during the second webinar in the credit risk series. Nearly three out of four respondents reported financial or risk trends as one of their institution’s main factors for determining loan grades, a pleasant surprise to Wear. “Many of the loan grading systems I’ve seen seem to lack ways to account for trends – I’m so happy to see that growing,” he said.

The main factors institutions use to determine the total loan grade are debt service coverage/capacity (97.7%) and leverage/collateral coverage (85.6%), according to an informal poll conducted during the second webinar in the credit risk series. Nearly three out of four respondents reported financial or risk trends as one of their institution’s main factors for determining loan grades, a pleasant surprise to Wear. “Many of the loan grading systems I’ve seen seem to lack ways to account for trends – I’m so happy to see that growing,” he said.

Recessions can expose fissures in an institution’s loan grading system if the bank or credit union is not proactive. Much like credit memos, the loan grading system is often based on historical financial information. In an economic downturn, such as the one we are experiencing now, market conditions can rapidly deteriorate, which can have a quick and profound impact on a borrower’s financials. Therefore, including financial or risk trends in the total loan grade is increasingly important in times of recession.

As seen in this pandemic-related recession, certain industries, such as hospitality and restaurants, have been especially hard-hit. “I know some banks with concentrations in these segments downgrading to special mention most of their portfolio due to industry-wide risk. Also, your borrower might not even be a hotel, but if it sells primarily to hotels, an industry trend downgrade may be in order,” Wear said.

Longevity of a banking relationship is often used to bump up final loan grades – but without explanation. Wear encourages financial institutions to provide evidence, such as how the borrower supported debt service in a recession while incurring severe revenue losses, in order to show loan approvers and examiners the borrower’s character in tough times. Citing examples of character is one of Wear’s top suggestions for improving loan grading recessions, saying he’d “bet on character any day.”

Wear also recommends financial institutions carefully address how collateral coverage is evaluated. As revenues are pressured, secondary and tertiary sources of repayment are becoming increasingly important. Solid collateral valuation is critical to estimate loss given default. Adopting a forward-looking viewpoint to address fast-changing industry changes in supply and demand is important.

Qualitative adjustments tend to pop up in tougher economic times. Financial institutions will have to be flexible and work with their borrowers during these unprecedented times. The CARES Act and the Safe Harbor rules, as well as interagency guidance, have provided much-needed leeway for examiners and institutions alike to avoid rushing to classify credits suffering due to the coronavirus pandemic.

“I often tell my clients, ‘Don’t unintentionally not help those clients because you’re afraid of TDR – do the right thing,’” said Rob Newberry, Senior Advisor at Abrigo. There are likely still modifications and losses on the horizon, but once the dust settles, Newberry explained, understanding how to assess financials from 2020 in new loan grading will be critical, whether it’s by industry, or sector, or another factor.

More than six months after the coronavirus reached the U.S., there is still significant uncertainty regarding the pandemic and its subsequent economic impact. Credit risk management has been a cornerstone of community banking, and it will continue to be a top priority in this unique credit environment. By managing risk effectively and efficiently, financial institutions can also help their bank or credit union grow. To learn more about credit risk best practices for growth and profitability, don’t miss our final two webinars in the “How to Manage Credit Risk in a Recession: A Series Examining Best Practices.”

About the Author